The following is adapted from Quit Getting Stiffed.

It is extremely important to understand your lien rights and what you need to do to protect them. The lien is your golden ticket to getting paid. Knowing this, why wouldn’t you want to do everything in your power to protect your right to payment? Let’s take a look at sending effective and timely lien notices.

Why are effective and timely lien notices so important?

Sending timely and proper notices is the key to perfecting your lien rights.

There is nothing wrong with sending notice early or sending more notices than what is required by law. If you send notice as soon as you realize there is an issue, it will give all parties involved more time to resolve it. Don’t forget that your lien rights will be lost if you send notices late or to the wrong people.

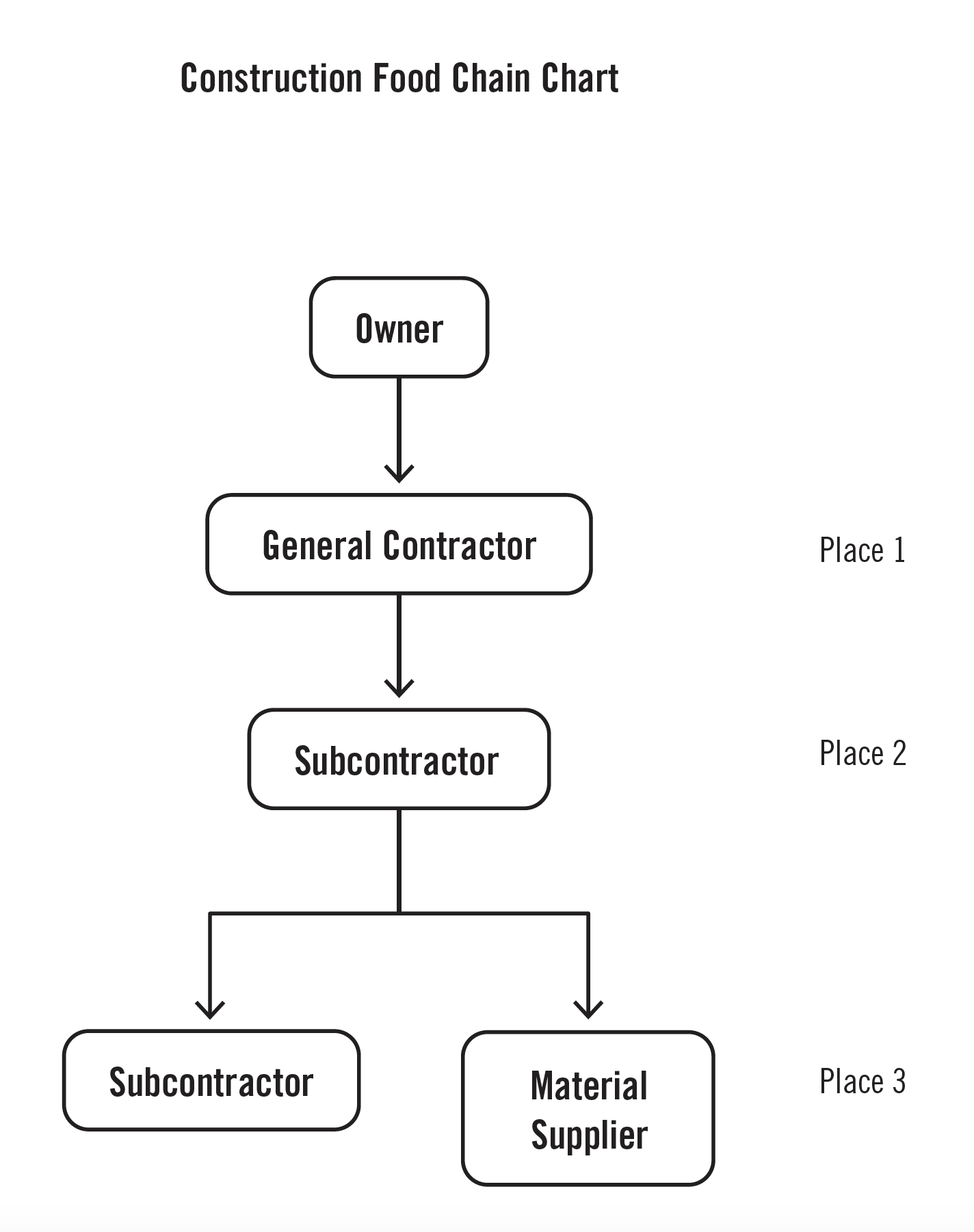

Notices let the owner and general contractor know if there is a kink in the food chain and the money is not making it to the lower places.

Requirements for effective notice

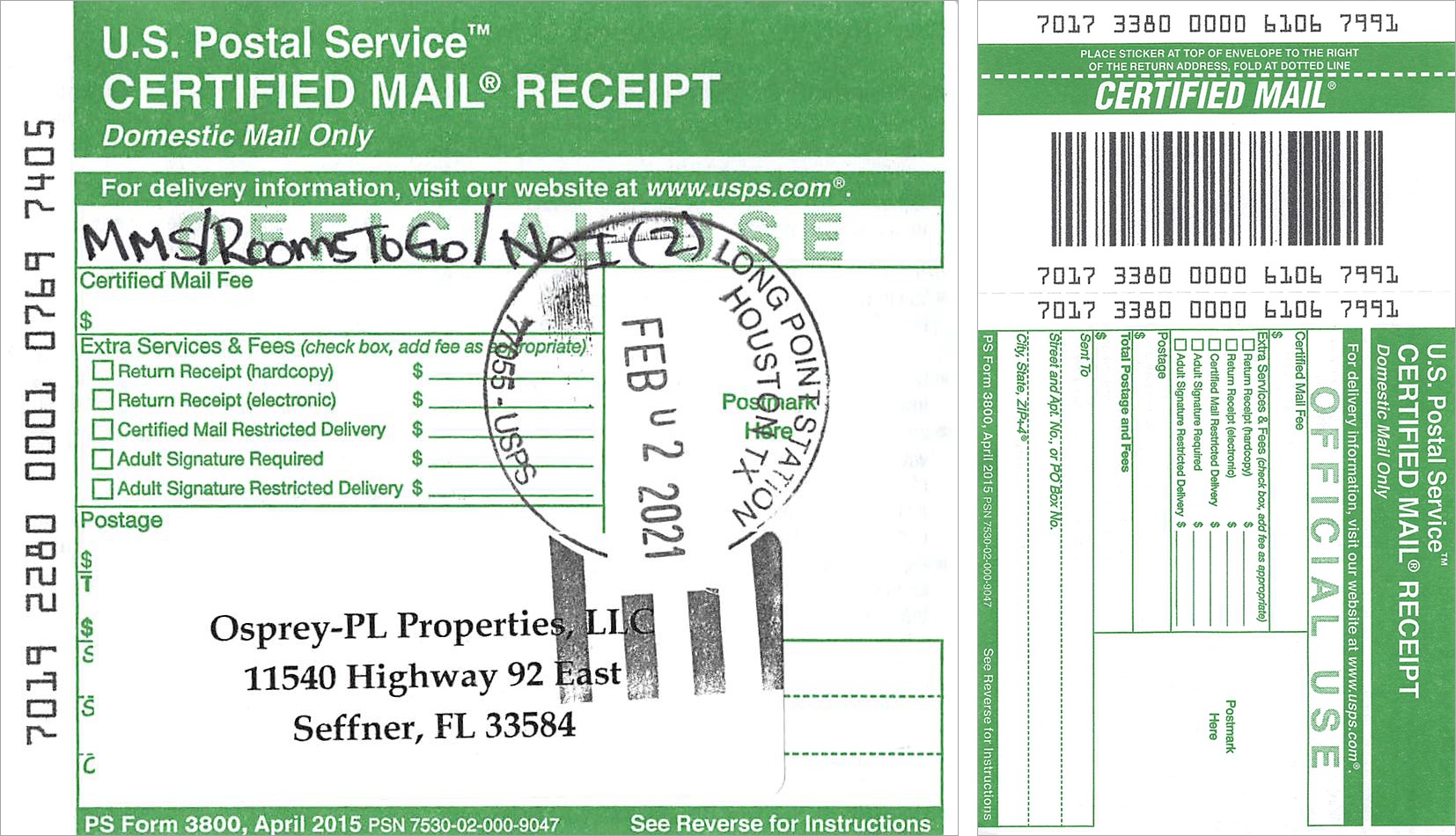

The only way to prove that effective and timely notice was sent is to have the stamped receipt. What happens if you don’t have this receipt? Then you can’t prove you sent effective and timely notice, and your lien will be invalid. We represented a lumber supply company that had used an online lien filing service to file a lien on a project for which they were owed $50,000. Once the lien was filed, they received a letter from the owner’s attorney asking for all the documentation that said their lien was valid. The lumber company sent the owner’s attorney everything the lien filing service provided them, but there was no stamped receipt from the post office verifying when their notices were sent.

On the post office website, you can check the history of the certified letter; according to the website, our client’s letters that needed to be sent on the 15th of the month were not entered into the post office system until the 17th of the month. That was all it took. The post office website saying the letter was not mailed on time and having no evidence to the contrary (like a stamped receipt) meant the lien was invalid and the $50,000 was gone. A lien can have a lot of leverage, but to get that leverage, you need to follow each step exactly as the law requires.

Timelines for effective and timely lien notices

The common misconception is that the timeline to send notices starts from the date of the last work done when the opposite is actually true. The timeline to send notice starts from the first month for which you are owed money. For example, if you are owed money for work done in January, February, and March, your timeline to send notice starts in January—not March. If you start your lien notice timeline from March, you will be late for the work done in January and February.

Another misconception is that you must file a lien for each month you are owed money. This is not true. You can keep sending notices for each month that you are owed money, but do not file the lien until your work or the project is complete, whichever comes first.

Invoice date does not matter

The timeline for notices starts when you actually did the work or provided the materials, not your invoice date. We’ll explain with an example. Super Brick Supplier (SBS) delivers materials to an office building project site on October 30. In accordance with SBS’s process, the invoice is not created and sent out until November 2. The timeline for SBS to send notice starts in October because that is when the materials were delivered, not the day the invoice was issued.

The early bird gets the worm

You do not lose any rights if you send notice early, and you can send multiple months in the same notice. It’s a good rule of thumb to send notice early moving forward in all your projects. Why wouldn’t you if you now know that there is no penalty in sending notice early and often.

Conclusion

The lien process is time sensitive, and each state has different requirements you must follow. Check out our blogs that break down all lien laws in all 50 states in the US if you’d like to do it yourself! If you are looking for lien assistance on your construction projects from a qualified construction attorney, don’t wait! If you need help, it’s crucial you team up with a knowledgeable Texas lien attorney that can set you and your company up for success. Start the process today and have a properly perfected lien and never worry about timely payment again.

For more advice on a Texas contractor’s collection and lien rights, you can find Quit Getting Stiffed on Amazon.

About Karalynn Cromeens

Author of Quit Getting Screwed: Understanding and Negotiating the Subcontract, and creator of The Subcontractor Institute, has been a licensed attorney for more than seventeen years. She has spent her entire legal career in construction law, advising countless clients on how to avoid litigation. Karalynn is on a mission to educate and inform subcontractors about the importance of understanding their lien and collections rights, sparking change and leveling the playing field in the construction industry.